Hello, Equip~

How you doing today? Are those new shoes?

They look nice.

I’m James and I’m currently applying to the Data Analyst 1 position.

My favorite part of analysis is the part where I get to show, instead of tell.

So lets take a look at some data points you probably already know of, but may find interesting!

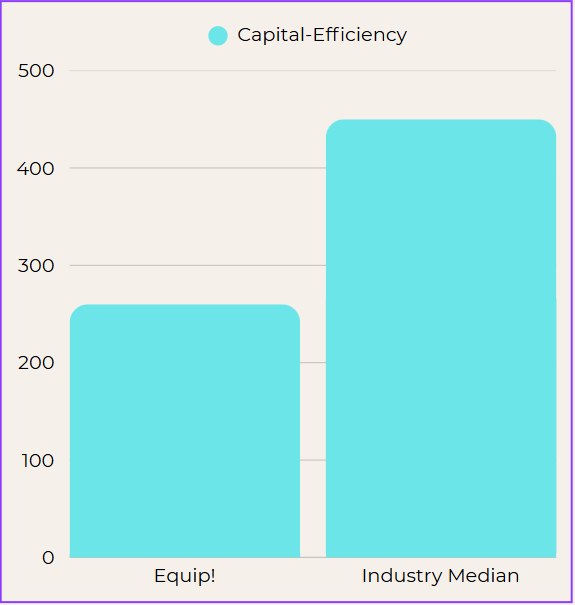

Capital Efficiency Snapshot

The Good Stuff

A quick scan of useful insights based off public records.

Cumulative Funding (2019 - 2025): ~ $130MM

Current head-count band: ~500 employees

Funding / Employees = $260 k/employee

Equip is scaling people faster than it is burning venture cash. At ~ $260k per employee, it looks 35-45 % more capital-efficient than the median venture-backed tele-health peer group—an angle the leadership team will appreciate when courting additional payer contracts or strategic investors.

Clinical Outcome vs Industry Benchmark

Equip’s virtual FBT: 75-81% Success rate

Traditional in-person FBT: 40-60% median

Equip meets the gold-standard ceiling of in-person FBT while eliminating geographic restrictions—evidence that virtual care can raise the floor of treatment quality nationwide.

Access Footprint

Commercial lives with in-network coverage: 115m Americans

Share of U.S. population (2025 est. = 333m): ~34.5%

Showing coverage as a percent of total population, not just insured lives, communicates strategic head-room: every additional payer contract moves the 34.5 % needle.

Tactical Next Steps

Head-count CAGR tile

10x growth in 24 months, that’s 216% CAGR

Hyper-growth can inform resource-planning considerations

State-Level Prevalence Heat-map

Overlay CDC eating-disorder prevalence with Equip coverage

Pinpoints expansion priorities (e.g., Medicaid gaps)

Payer Concentration Pie

Scrape the ‘15+’ plans list

Which carriers drive coverage? Examine risk diversification.

Outcome-per-Dollar Metric

Marry cost data (typical inpatient ED stays run $1,200/day) with Equip’s virtual cost

Illustrates obvious ROI for payers

Early-Success predictor model

Gather insights from published research

>5 lb gain by week 4 predicts 85% remission; we could propose an internal alert so Equip clinicians can intensify care for at-risk patients sooner

Company Stats

Some miscellaneous statistics you might find neat.

Funding Timeline

Clinical Outcome Highlights

Hitting Our Targets

Pushing Technology

Virtual Family-Based Treatment (vFBT) shows outcomes equal to—or better than—in-person care.

Milestones

Recent wins, worth celebration!

June 2022

June 2023

September 2023

National Expansion to all 50 States!

〰️

National Expansion to all 50 States! 〰️

Named a TIME 'Most Influential Company'

〰️

Named a TIME 'Most Influential Company' 〰️

Services expanded to adults!

〰️

Services expanded to adults! 〰️

Equip Health — Series B funding announcement ($58 M, Feb 2022) Equip Health

Endpoints News — “Eating-disorder telehealth startup Equip raises $35 M” (Apr 2023 filing) Endpoints

Fierce Healthcare — Profile with 115 M covered lives & 15+ payer contracts (head-count note) Fierce Healthcare

Fierce Healthcare — Expansion-to-adults & General Catalyst follow-on investment (Sept 2023) Fierce Healthcare

Equip Health — Outcomes blog: virtual care in all 50 states; 80 % weight-restoration success Equip Health

LinkedIn company page — employee band & founding year LinkedIn

Growjo profile — estimated revenue, employee count, YoY growth Growjo

TIME 100 Most Influential Companies 2023 entry for Equip Time

MedCity News — Coverage of adult-service launch & added funding MedCity News

Equip Academy landing page — public CE/CME program details Equip Health

Rienecke et al., “Early weight gain predicts treatment response in adolescents with anorexia nervosa” (PDF, Univ. of Michigan DeepBlue repository) — 4-lb/2.3 kg week-4 predictor Deep Blue Repositories

Le Grange et al., NIH PMC article “Early weight gain predicts outcome in two treatments for adolescent AN” (remission predictor) PMC

Lock et al., NIH PMC article “Can Adaptive Treatment Improve Outcomes in Family-Based Treatment…” (2.3 kg threshold reference) PMC